May 11, 2023

Mitch O'NeillIt’s not a rhetorical question by the way. Can we? Right now there’s some indicators that suggest perhaps not.

First though, there’s this idea that networks can use voltage management to provide demand response. To skip a lot of the details the basic idea is:

The opposite effect happens for a voltage increase.

And tada, you can reliably change demand over a prescribed period. It’s very low cost compared to how we typically do demand response. Instead of ringing up industrial operators or installing smart internet connected devices we just change the voltage. Networks already install things to change the voltage on their network as part of their obligations in being a network service provider.

In the UK they’ve tested, regulated and deployed this voltage management induced demand flexibility in their balancing markets. Networks bid and operate it in competitive markets and split the benefits rather equally with the customers. Grids wrote about it here, and it should be considered a “good outcome” companion piece to the disappointment that’s about to be described here.

And now to Australia’s National Energy Market. We’ve tested this technology out through two ARENA trials. Both were run by United Energy, one demonstrating the ability to use demand response through voltage management in RERT, the other in contingency FCAS. Very cool trials. Extremely technical. If you want to see their SCADA group functions or all the VRRs that had to be replaced with, checks notes, A-Ebrele REG-Ds (those good old REG-Ds) then these reports are for you.

Long story short though, United Energy can reliably provide demand flexibly in existing NEM markets. They even did a commercial case of how much money would be earned through providing these services, which builds the business case of networks investing time and resources into these operations. This is great!

One thing wasn’t really talked about in the hundreds of pages of reports though:

They… aren’t allowed to commercially offer it.

Don’t take my word for it, here’s the AER: “DNSPs are prohibited from providing RERT services to AEMO under the Ring-fencing guideline (electricity distribution) (the Guideline).” One would expect the AER to say the same about FCAS too.

From here it gets kind of weird, and honestly I’m not going to take you too far down this rabbit hole, but just to quickly take a dip: United Energy submitted a draft application to register as a Market Ancillary Service Provider. AEMO responded outlining many technical and non-technical considerations such as how the load profile changes and what metering they’re using. No AEMO consideration though for… “uhhh… you’re a regulated monopoly who can’t register as a market participant”. There’s even a timeline for United Energy being registered in the market, hooking up to AEMO bidding and dispatch systems and figuring out pricing strategies before the end of 2021. It’s on Table 6 of the ARENA report. Weird. And then it makes you think, hold on how exactly did United Energy provide RERT services to AEMO under the ARENA trial?

In the end, who cares, bygones be bygones and all that. Case in point though, a lot of focus on technical and commercial outcomes, not a lot of thought on regulatory controls.

We then let this voltage management capability lie, until September 26 2022 when AEMO informed the AER of a little problem on its hands. AEMO did not have enough RERT capacity for summer mere months away and urgently needed to find some more. Had it considered making it easier for energy consumers to participate in RERT, such as reducing their ever growing minimum registration sizes (now 10MW!) or doing more market development? No. Instead AEMO was asking the AER for an urgent long-term ring fencing waiver to allow DNSPs to provide RERT via voltage management.

With mere months before the AEMO imposed “perhaps we’ll have blackouts if you don’t approve this” deadline of January, the AER didn’t really have a lot of wiggle room in the matter. They consulted, competitive players complained loudly with some valid issues and some invalid ones, consumers groups said “I guess this is a good thing for consumers?” while quite meekly bringing up that maybe consumers should get a cut of the revenue too, and networks said they were totally ready – largely due to the hundreds of pages of technical reports we gained from the ARENA trials. In the end the AER said “this makes RERT price go down. Good for consumers! Ring fencing waiver granted.” and with that networks were given access to the RERT markets til 2025.

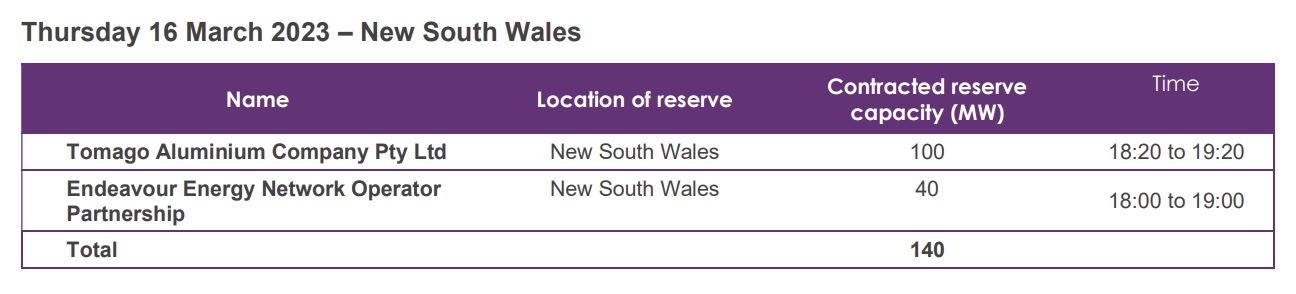

This network RERT capability has almost been used once so far. Endeavour Energy entered into a RERT agreement with AEMO for 40MW in March but weren’t activated therefore earned no money.

In the haste some things were overlooked. One example to focus in on: the Shared Asset Guideline really sucks in this situation, both for consumers and the networks.

The Shared Asset Guideline covers what happens when networks earn money from their assets when doing things that aren’t part of their obligations of being an electricity network. An example of this is leasing space on their powerlines for a communication company to put comms wires or a Starlink dish. Networks get to keep 100% of that revenue, called un-regulated revenue, except in cases where their un-regulated revenue is more than 1% of their total revenue, in which case they give 10% to consumers and keep 90%.

This 1% of total revenue is unlikely to be hit, so in the case of earning RERT revenue networks get to keep 100% of the money, leaving consumers with nothing.

The thing about RERT is it’s paid for by consumers, but also it’s supplied by consumers. This means that a lot of RERT costs net out within the group of energy consumers. For instance if an aggregator provides RERT at $5,000 where their customers get $4,000 and they take a $1,000 aggregator cut, overall consumers have only paid $1,000 for that capacity. This means that from an overall test, consumers are worse off with $3,000 network RERT than that theoretical $5,000 aggregator RERT. There are enormous distributional effects here that would need to be considered too, and perhaps $3,000 in net costs for network RERT with better distributional effects is better than $1,000 in net costs when it’s supplied by the aggregator. But it’s an interesting area to be looked at.

Further, networks probably don’t want this arrangement either as it creates a tricky public relations situation for them. While some networks stated:

“In our view, the provision of RERT services constitutes a rental of distribution assets (in this case SCADA and RTUs) to a third party (AEMO)”,

another, perhaps more accurate way to present this situation is: AEMO is buying demand response capacity from the network, that demand response comes from customer assets, and networks are controlling that demand response by varying the voltage levels. In effect networks are the RERT aggregator of customer assets and using voltage to manage these assets rather than ringing operators up or installing smart internet connected devices. In this scenario customers don’t get a choice whether they sign up to this aggregator, and the aggregator gets to take 100% of the revenue.

Perceptually it gets even worse as not only do customers not get paid for this demand flexibility, they’re the ones that pay the costs for it. This means that customers are literally paying networks to provide flexibility into the market from their own assets.

Creepy!

In major props to Ausgrid and Essential, according to the AER summary of verbal feedback these network reps said:

“Ausgrid and Essential Energy also recognised the need for a mechanism outside of the Shared Asset Guideline to share RERT revenue with consumers. Sharing unregulated revenue earned from the use of regulated electricity supply assets will be important as increasing opportunities emerge for DNSPs to participate in markets for new services.”

And that’s really the main point in a nutshell. The Shared Asset Guideline seems inappropriate when considering using network assets in conjunction with consumer assets to deliver a service.

We had ample time to consider revenue sharing and other issues in introducing this mechanism into RERT and other competitive markets during the years of trials we were carrying out, which included many RERT and FCAS dispatches from networks using voltage control. Instead the AER gets caught in a corner, has to make some quick regulation as a band-aid, and says it’ll get to regulating this properly later.

“The AER will consider undertaking a review of the Shared Asset Guideline as part of its 2023/24 work program.” – AER Final Decision

And I hope they do. The AER CER strategy doesn’t really mention this, but strategies are inherently high level, perhaps it’s somewhere in the details.

To cut a long blog post short it’s a similar story with network owned community batteries. ARENA funding many interesting trials and investigations. The AER considering how to properly regulate it in 2021 but ruling that it was too early to do it properly and instead put in interim measure. At the very end of 2022 there was an emergency, this time of the political nature, where the federal government needed 400 community batteries rolled out before the next election and that means getting networks to own and install a lot of them. The AER with limited options put up some adhoc temporary regulatory scaffolding in the time it had available to it.

This isn’t just an AER thing either. The AER is severely constrained as it must act in accordance with the National Electricity Rules. So it’s likely we’ll need changes to the NER. For instance 6.4.4(c)(3), one of the share asset principles could be extended to say:

“or consumer assets are used in conjunction with network assets to provide a service”,

to ensure the AER can allocate revenues to consumers even when networks are under their “1% of total revenue” cap. Additionally there could be provisions made to encourage the AER to make multiple revenue sharing categories under the Shared Asset Guideline, just like in the UK where they have many different categories for directly remunerated services.

The AEMC have talked about many of these issues in their annual reviews of the economic regulatory frameworks in which networks are regulated. The latest one I’ve been able to find, from 2020, states many of these issues around defining the new roles of the DNSP (here in section 2.2) but little progress to date has been made.

This post tells a story about networks in the RERT market, but it’s to demonstrate a symptom of a larger issue. Networks in conjunction with industry are driving ahead demonstrating technical and commercial feasibility of their new roles and capabilities as a Distribution System Operator. The regulatory feasibility and options analysis remains rather stagnant, and instead must reactively respond in short order when the energy system demands that these new DSO capabilities be immediately implemented. We don’t want to overconstrain innovation, but by progressing our understanding of how these new capabilities could be regulated, we can roll them out in a more considered manner that is more efficient and also leaves everyone feeling a bit happier about the process.

Thanks for reading, and once again the post on the UK perspective is here.