April 20, 2023

Mitch O'NeillThe era of stability services supplied by DER in Australia’s National Electricity Market started in July 2017 when the Market Ancillary Service Provider (MASP) was introduced. This allowed specialised companies to use DER for frequency control ancillary services (FCAS) without also having to be your energy retailer.

EnerNOC (now Enel X) hit the ground running signing up a bunch of commercial and industrial (C&I) sites and trying to inject humour into a pretty bland energy market. They got started with their first aggregated FCAS fleet in October of that year and very quickly got to a respectable size in the NEM.

Since then we’ve had other commercial MASP operators come in, residential VPPs get involved and even (*shock*) retailers join the party. So how’s it all going now, almost 5 years later?

Notes:

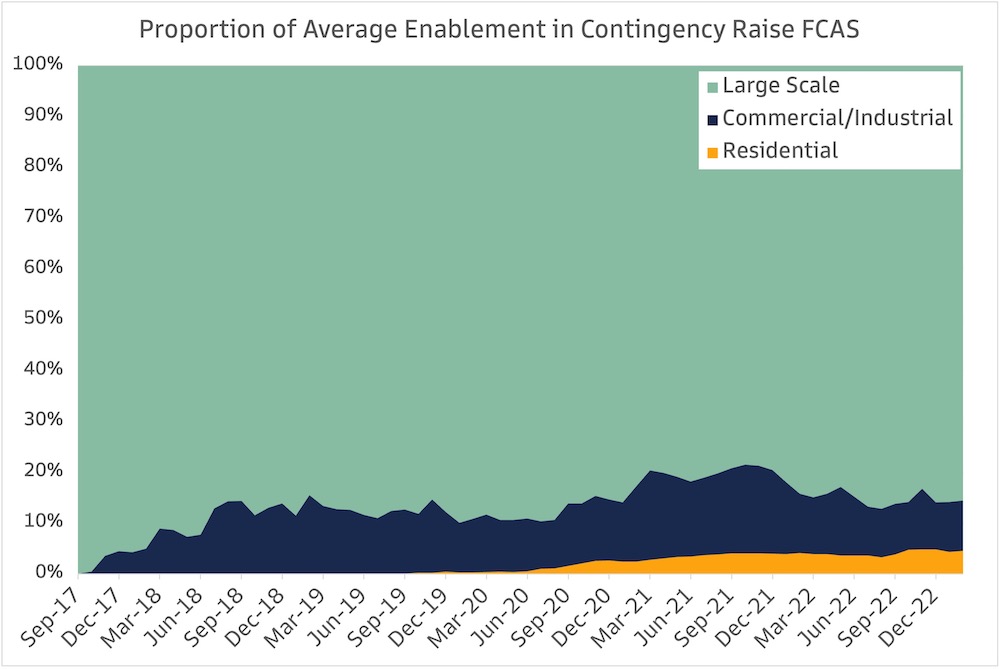

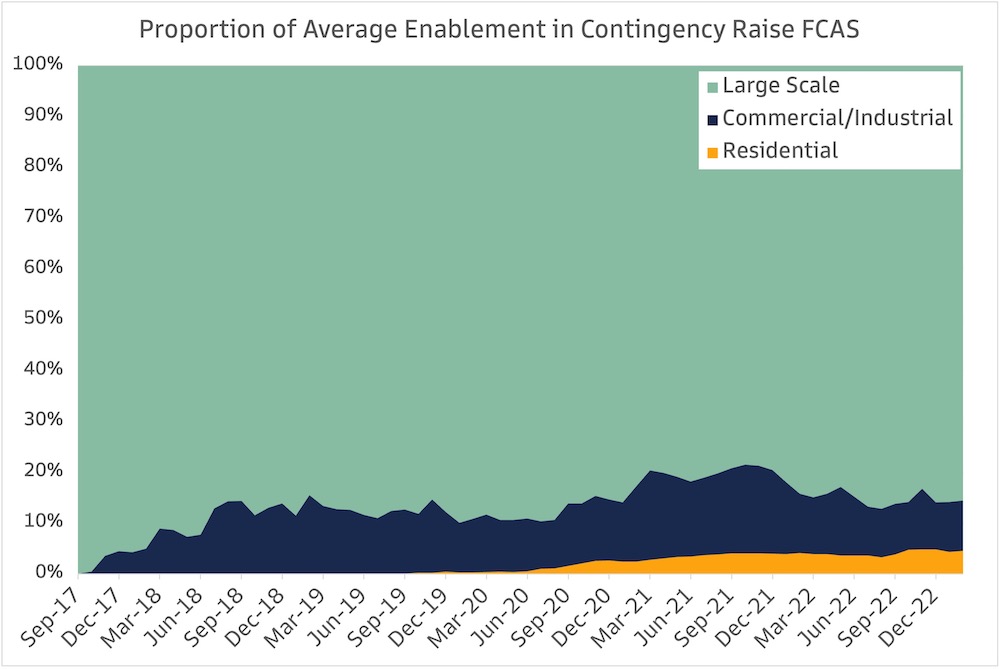

There’s 15 market participants with 508MW of registered DER FCAS capacity. 56MW of this is at the residential level from batteries, and 452MW from the commercial and industrial level mostly from operational demand response and embedded generation. On average about 50% of the residential capacity and 10% of the C&I capacity is enabled in the market at any time.

DER is a material portion of the FCAS market but the large majority still comes from large scale sources. Interestingly the DER proportion has somewhat stagnated since the start of 2021, with a drop off in C&I enablement. Why is that?

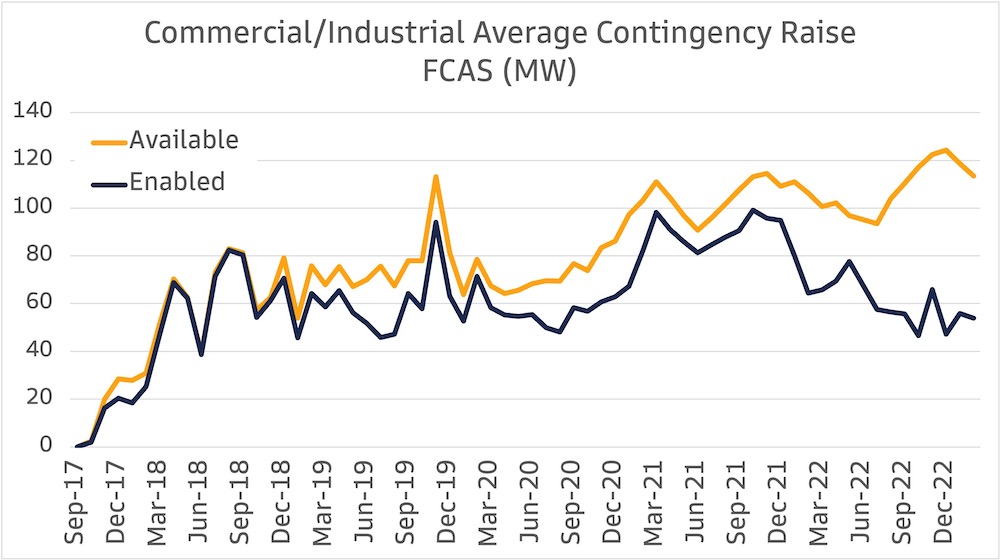

Commercial & Industrial

While C&I capacity that’s available to the market has continued to increase, the amount that is enabled by central dispatch has decreased. This could be due to C&I operators becoming less ‘price takers’ and getting more sophisticated with their bidding, or increased competition for FCAS from utility scale batteries pushing C&I capacity out of the dispatch stack.

The overwhelming majority of this capacity comes from Enel X, still to this day, although Boral (previously under the EnelX MASP) have gone off as their own participant since October 2020, taking about 10% of the C&I capacity. The remaining providers bid a couple of MW on average combined.

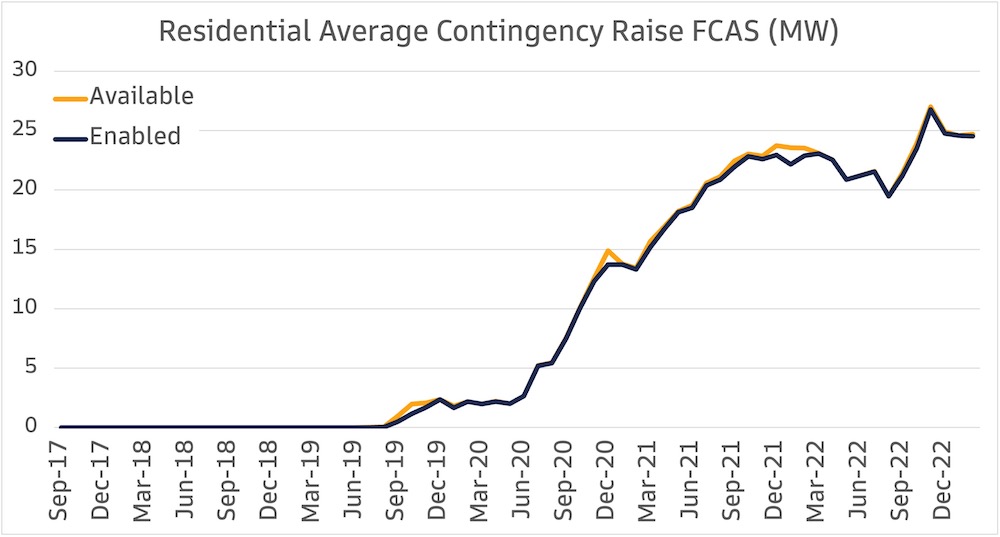

Residential

Residential capacity is provided from home batteries. As the capacity the battery isn’t using to charge from solar or offset household usage is often just sitting around doing nothing, participants often ‘price take’ (by bidding in at a low or zero price) to ensure that left over capacity is utilised in the FCAS markets. This accounts for the enabled capacity being almost equivalent to the available capacity, as often there’s no opportunity cost for putting this capacity into FCAS.

This capacity is a lot more distributed between providers. EnergyLocals/Tesla are the biggest provider, but Reposit, AGL, Simply and others are also providing material and growing capacity into the market.

Thanks for reading, and if you’d like to read more about FCAS check out this rule change.